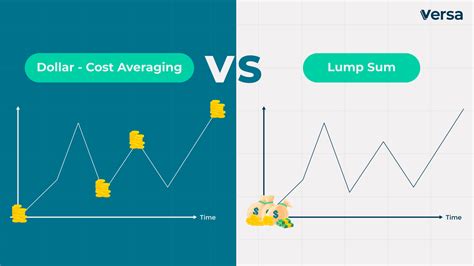

Lump Sum Investing vs. Dollar Cost Averaging

The world of investing presents us with a myriad of options, each carrying its own set of advantages and drawbacks. Two such strategies that often grace the headlines are lump sum investing and dollar cost averaging. While both aim to multiply your hard-earned cash, their approaches couldn’t be more different. So, let’s dive into the nitty-gritty to determine which strategy aligns best with your financial goals and risk tolerance.

Lump Sum Investing

Lump sum investing, as the name suggests, involves committing a substantial chunk of your savings to the market in one go. This could be the proceeds from a property sale, an inheritance, or simply a sizable sum that’s been gathering dust in your account. The allure of lump sum investing lies in the potential to capitalize on favorable market conditions and maximize returns.

However, timing is everything in the stock market, and lump sum investing comes with an inherent risk. If the market takes a downturn shortly after you’ve invested, your funds could be exposed to significant losses. Think of it like diving into a swimming pool—the water might be perfectly clear when you jump in, but who knows what lurks beneath the surface?

So, if you’re considering lump sum investing, it’s crucial to have a long-term mindset and a solid understanding of the market’s ups and downs. You need to be comfortable with the potential for temporary setbacks along the way.

Now, let’s turn our attention to dollar cost averaging, an investing strategy that takes a more cautious approach.

**Lump Sum Investing vs. Dollar Cost Averaging: Which Investment Strategy Is Right for You?**

When it comes to investing, there are two main schools of thought: lump sum investing and dollar cost averaging. Lump sum investing involves investing a large sum of money all at once, while dollar cost averaging involves investing a fixed amount of money at regular intervals over a period of time. Both strategies have their own advantages and disadvantages, and the best choice for you will depend on your individual circumstances and investment goals.

**Lump Sum Investing**

Lump sum investing can be a good option if you have a large sum of money to invest and you’re confident in the long-term performance of the market. By investing all of your money at once, you’ll be able to take advantage of any upward movement in the market right away. However, lump sum investing also comes with some risks. If the market takes a downturn after you invest, you could lose a significant amount of money.

**Dollar Cost Averaging**

Dollar cost averaging is a less risky investment strategy than lump sum investing, but it can also be less rewarding. With dollar cost averaging, you’ll invest a fixed amount of money at regular intervals, regardless of the market fluctuations. This means that you’ll buy more shares when the market is down and fewer shares when the market is up, which can help to smooth out your returns over time.

Dollar Cost Averaging

In contrast, dollar cost averaging is a technique where you regularly invest a fixed amount of money over time, regardless of market fluctuations. This strategy can be beneficial for several reasons.

First, it helps to reduce the impact of market volatility. When you invest a lump sum, you’re essentially betting that the market will continue to rise. However, if the market takes a downturn, you could lose a significant amount of money. Dollar cost averaging, on the other hand, helps to spread out your risk by investing smaller amounts over time. This means that you’re less likely to lose a large amount of money if the market takes a downturn.

Second, dollar cost averaging can help you to buy more shares when the market is down. When the market is down, share prices are lower. This means that you’ll be able to buy more shares for the same amount of money. When the market recovers, the value of your shares will increase, and you’ll be able to profit from the market’s growth.

Third, dollar cost averaging can help you to stay disciplined with your investing. It can be tempting to try to time the market and invest when you think the market is about to go up. However, this is a difficult strategy to execute successfully. Dollar cost averaging, on the other hand, takes the emotion out of investing. You simply invest a fixed amount of money at regular intervals, regardless of what the market is doing.

Dollar cost averaging is a simple and effective investment strategy that can help you to reach your financial goals. If you’re not sure which investment strategy is right for you, talk to a financial advisor. They can help you to assess your individual circumstances and investment goals and recommend the best strategy for you.

Lump Sum Investing vs. Dollar Cost Averaging: Weighing the Pros and Cons

When it comes to investing, there are two main strategies to choose from: lump sum investing and dollar cost averaging. Each approach has its own set of benefits and drawbacks, and the best choice for you will depend on your individual circumstances and investment goals.

Lump Sum Investing

With lump sum investing, you invest a large amount of money into one security or diversified assets all at once. This can be a good strategy if you have a significant amount of money to invest and you are confident in your ability to time the market.

Benefits of Lump Sum Investing

There are several potential benefits to lump sum investing. First, it allows you to capitalize on potential market upswings. If the market is rising, you will see a greater return on a lump sum investment than you would on a dollar cost averaging investment. Second, lump sum investing can be more tax-efficient. When you invest a larger amount of money, you can take advantage of lower tax rates.

Drawbacks of Lump Sum Investing

There are also some potential drawbacks to lump sum investing. First, it can be more risky than dollar cost averaging. If the market declines after you invest, you could lose a significant amount of money. Second, lump sum investing can be more difficult to do if you do not have a large amount of money to invest.

Dollar Cost Averaging

With dollar cost averaging, you invest the same amount of money at regular intervals, regardless of the market conditions. This strategy can help to reduce your risk of loss, as it ensures that you are not buying all of your investments at the same time.

Benefits of Dollar Cost Averaging

Dollar cost averaging has several potential benefits. First, it can help to reduce your risk of loss. By investing the same amount of money at regular intervals, you are less likely to be affected by market fluctuations. Second, dollar cost averaging can make it easier to start investing. By investing smaller amounts over time, you can gradually build up your investment portfolio without having to make a large upfront investment.

Drawbacks of Dollar Cost Averaging

There are also some potential drawbacks to dollar cost averaging. First, it can result in lower returns than lump sum investing. If the market is rising, you will likely see a greater return on a lump sum investment than you would on a dollar cost averaging investment. Second, dollar cost averaging can be more time-consuming than lump sum investing.

Lump Sum Investing vs. Dollar Cost Averaging: Which is Right for You?

When it comes to investing, there are two main approaches: lump sum investing and dollar cost averaging. Lump sum investing involves investing a large amount of money all at once, while dollar cost averaging involves investing smaller amounts of money at regular intervals. Both approaches have their own advantages and disadvantages, so it’s important to understand the differences before you decide which one is right for you.

Benefits of Dollar Cost Averaging

Dollar cost averaging reduces risk by spreading out your investments over time, protecting against market downturns. When you invest a lump sum, you’re taking on the risk that the market will decline before you have a chance to benefit from it. However, with dollar cost averaging, you’re only investing a small amount of money each month, so if the market does decline you won’t lose as much money. The stock market is like a roller coaster. Some days it goes up, and some days it goes down. You can’t predict the future and jump off at the perfect time. Dollar-cost averaging is like staying in the middle of the car and hanging on. You’ll have some ups and downs, but you’re less likely to fall out at the bottom.

Dollar cost averaging can also help you to save money. When you invest a lump sum, you’re buying at the current market price. However, if you invest smaller amounts of money at regular intervals, you’re more likely to buy at a lower average price over time. This is because you’re buying more shares when the market is down and fewer shares when the market is up. It’s like buying groceries on sale. You get more for your money.

Finally, dollar cost averaging can help you to stay disciplined with your investing. When you set up a regular investment plan, you’re less likely to get scared and sell your investments when the market declines. This is because you’re already invested and you know that your money will recover over time. It’s like being on a diet. If you cheat today, you’ll be less likely to stick with it tomorrow.

Ultimately, the best way to decide whether lump sum investing or dollar cost averaging is right for you is to consider your individual circumstances. If you have a lot of money to invest and you’re comfortable with taking on risk, then lump sum investing may be a good option for you. However, if you’re more risk-averse or you don’t have a lot of money to invest, then dollar cost averaging is probably a better choice.

**Lump Sum Investing vs. Dollar Cost Averaging: Which Approach Is Right for You?**

When it comes to investing, one of the first decisions you’ll face is whether to invest a lump sum or dollar-cost average. Lump sum investing involves putting all of your money into an investment at once, while dollar-cost averaging (DCA) is a strategy of investing smaller amounts of money over time. Both approaches have their own pros and cons, so it’s important to understand the differences before making a decision.

Lump Sum Investing

Lump sum investing is a straightforward approach that involves investing all of your available capital at once. This strategy can be beneficial if you have a large sum of money to invest and you’re confident in the market’s future performance. However, it’s important to keep in mind that lump sum investing carries more risk than DCA, as you’re more exposed to market fluctuations.

One of the main benefits of lump sum investing is that it gives you the potential to earn higher returns over time. By investing all of your money at once, you’re taking advantage of the power of compounding interest. However, it’s important to remember that lump sum investing is not without risk. If the market takes a downturn after you invest, you could lose a significant amount of money.

Dollar-Cost Averaging

Dollar-cost averaging is a less risky approach to investing than lump sum investing. With DCA, you invest a smaller amount of money at regular intervals, regardless of the market’s performance. This strategy helps to reduce your overall risk by spreading out your investments over time.

One of the main benefits of dollar-cost averaging is that it helps to reduce your risk of investing at a market peak. By investing a small amount of money each month, you’re less likely to be affected by short-term market fluctuations. However, it’s important to remember that DCA can also result in lower returns over time, as you’re not taking advantage of the power of compounding interest as much as you would with lump sum investing.

Choosing the Right Approach

The best approach for you will depend on your investment goals, risk tolerance, and financial situation. If you have a large sum of money to invest and you’re confident in the market’s future performance, then lump sum investing may be a good option for you. However, if you’re more risk-averse or you’re not sure how the market will perform, then dollar-cost averaging may be a better choice.

Consider your investment goals

What are you investing for? Are you saving for retirement, a down payment on a house, or something else? Your goals will help you decide how much risk you’re willing to take and how long you’re willing to invest for.

Assess your risk tolerance

How much risk are you comfortable with? If you’re not sure, consider your age, financial situation, and investment experience.

Evaluate your financial situation

Do you have enough money to invest a lump sum? Or would you rather spread out your investments over time? Your financial situation will help you decide which approach is right for you.

5. Additional Considerations

In addition to the factors listed above, there are a few other things to consider when choosing between lump sum investing and dollar-cost averaging.

One important consideration is the timing of your investment. If you’re investing for the long term, then the timing of your investment is less important. However, if you’re investing for a shorter period of time, then you may want to consider investing a lump sum if you believe the market is undervalued.

Another consideration is the frequency of your investments. With lump sum investing, you’ll invest all of your money at once. With dollar-cost averaging, you’ll invest a smaller amount of money at regular intervals. The frequency of your investments will depend on your financial situation and your investment goals.

Finally, you should also consider the fees associated with your investments. Some investments, such as mutual funds, have annual fees. These fees can eat into your returns, so it’s important to factor them into your decision-making process.

Lump Sum Investing vs. Dollar Cost Averaging: Which Is Right for You?

When it comes to investing, there are two main strategies to consider: lump sum investing and dollar cost averaging. Both offer pros and cons, and the best choice for you will depend on your individual circumstances, risk tolerance, and financial goals.

Lump Sum Investing

Lump sum investing involves investing a large sum of money all at once. This can be a good option if you have a substantial amount of cash available to invest and you believe the market is undervalued. However, it’s important to consider the potential for market volatility and the availability of a lump sum to invest.

Dollar Cost Averaging

Dollar cost averaging is a gradual investment approach in which you invest a fixed amount of money at regular intervals, regardless of the market conditions. This can be a good option if you’re not comfortable investing a large sum of money all at once or if you’re worried about market volatility.

Considerations for Lump Sum Investing

Market Volatility: The stock market is constantly fluctuating, so there’s always the potential for losses when you invest a lump sum. However, if you have a long-term investment horizon and you’re confident in your investment strategy, lump sum investing can be a good way to get started.

Availability of Funds: Lump sum investing requires having a large sum of cash available to invest. If you don’t have the funds, you may want to consider dollar cost averaging instead.

Investment Horizon: If you have a long-term investment horizon, lump sum investing can be a good option. However, if you need the money in the short term, you may want to consider dollar cost averaging instead.

Risk Tolerance: Lump sum investing can be riskier than dollar cost averaging, so it’s important to consider your risk tolerance before making a decision. If you’re not comfortable with the potential for losses, you may want to consider dollar cost averaging instead.

Investment Strategy: If you have a strong investment strategy and you’re confident in your ability to identify undervalued stocks, lump sum investing can be a good option. However, if you’re not sure about your investment strategy, you may want to consider dollar cost averaging instead.

Dollar Cost Averaging: Dollar cost averaging can be a good option if you’re not comfortable investing a large sum of money all at once or if you’re worried about market volatility. With dollar cost averaging, you can spread out your investments over time, which can help to reduce your risk. Additionally, dollar cost averaging can be a good way to discipline yourself to invest consistently, even when the market is not performing well. Dollar cost averaging can be a good option if you have a long-term investment horizon and you’re not worried about short-term market fluctuations. However, it’s important to remember that dollar cost averaging does not guarantee against losses, and you could still lose money if the market declines significantly.

**Lump Sum Investing vs. Dollar Cost Averaging: Which is Right for You?**

When it comes to investing, deciding how to allocate your money can be a daunting task. Two popular investment strategies are lump sum investing and dollar cost averaging. Understanding the pros and cons of each can help you make an informed decision that aligns with your financial goals and risk tolerance.

Lump sum investing involves investing a large amount of money at one time. This approach can be beneficial if you have a large sum of money available and believe that the market is undervalued. However, it also carries more risk, as you are investing all of your money at a single point in time.

Dollar cost averaging, on the other hand, involves investing a fixed amount of money on a regular basis, regardless of the market conditions. This approach can help you reduce your risk by spreading out your investments over time and taking advantage of both market upswings and downswings.

Before deciding which investment strategy is right for you, consider these factors:

**Your Risk Tolerance**

Lump sum investing is more suitable for investors with a high risk tolerance. Dollar cost averaging is more appropriate for investors with a lower risk tolerance.

**Your Investment Horizon**

Lump sum investing can be more effective over longer investment horizons, while dollar cost averaging can be more effective over shorter investment horizons.

**The Market Outlook**

If you believe that the market is undervalued, lump sum investing may be a better option. If you are unsure of the market outlook, dollar cost averaging may be a wiser choice.

Dollar Cost Averaging Considerations

Dollar cost averaging is a suitable strategy for long-term investors who value consistency and risk reduction. Here are some factors to consider when using this approach:

1. **Start investing early:** The sooner you start dollar cost averaging, the more time you have to benefit from compound interest and reduce your overall risk.

2. **Invest regularly:** Set up a regular investment plan and stick to it. This will help you discipline yourself and take advantage of market volatility.

3. **Don’t try to time the market:** It’s impossible to predict when the market will go up or down. Instead, focus on investing consistently over time.

4. **Rebalance your portfolio regularly:** As your investment goals and risk tolerance change, you may need to rebalance your portfolio. This involves selling some assets and buying others to maintain your desired asset allocation.

5. **Don’t panic sell:** When the market takes a downturn, it’s tempting to sell everything and cut your losses. However, this is usually a mistake. Instead, stay invested and ride out the storm.

6. **Be patient:** Dollar cost averaging takes time to work. Don’t expect to get rich quick. Instead, focus on building a solid financial foundation for the future.

7. **Consider your financial situation:** Dollar cost averaging can be a good option for investors who have a stable income and can afford to invest regularly. However, it may not be the best choice for investors who are nearing retirement or have other financial obligations.

Lump Sum Investing vs. Dollar Cost Averaging: Which Is Right for You?

Investing is a great way to grow your money over time, but there are many different ways to go about it. Two common strategies are lump sum investing and dollar cost averaging. With lump sum investing, you invest a large sum of money all at once. With dollar cost averaging, you invest a smaller amount of money at regular intervals, such as monthly or quarterly.

There are pros and cons to both approaches. Lump sum investing can be more profitable if the market is rising, but it can also be more risky. Dollar cost averaging can be less profitable, but it is also less risky.

The best approach for you will depend on your individual circumstances and investment goals.

Factors to Consider

When deciding between lump sum investing and dollar cost averaging, there are a few factors to consider:

Investment goals: What are you investing for? Are you saving for retirement, a down payment on a house, or a child’s education?

Risk tolerance: How much risk are you comfortable with? Are you willing to lose money in the short term in order to potentially make more money in the long term?

Time horizon: How long do you have to invest? If you have a long time horizon, you can afford to take more risk.

Lump Sum Investing

Lump sum investing is a strategy where you invest a large sum of money all at once. This can be a good option if you have a large amount of cash available to invest, and if you are confident that the market is going to rise.

However, lump sum investing can also be more risky than dollar cost averaging. If the market takes a downturn after you invest, you could lose money.

Dollar Cost Averaging

Dollar cost averaging is a strategy where you invest a smaller amount of money at regular intervals, such as monthly or quarterly. This can be a less risky option than lump sum investing, because you are not investing all of your money at once.

However, dollar cost averaging can also be less profitable than lump sum investing, especially if the market is rising. This is because you are not taking advantage of compound interest.

Which Is Right for You?

The best approach for you will depend on your individual circumstances and investment goals. If you have a large amount of cash available to invest, and you are confident that the market is going to rise, lump sum investing may be a good option for you.

If you are not comfortable with taking on a lot of risk, or if you have a shorter time horizon, dollar cost averaging may be a better option.

Conclusion

Understanding the principles and benefits of both lump sum investing and dollar cost averaging can help you make informed investment decisions. There is no one-size-fits-all approach, so it is important to consider your individual circumstances and goals.

No responses yet